It’s possible to avoid paying ATM withdrawal fees in Spain but you need to be very careful about which machines you use. Although some banks in Spain don’t charge any ATM fees at all, many of them do and the charges involved can be as high as €5 per cash withdrawal.

I’ve spent a lot of time in Spain and things have changed since the first time I began using Spanish ATMs. Some of the banks that didn’t charge cash withdrawal fees in the past have started to do so. It’s a bit disappointing, but that’s the way life is. I hate paying ATM fees. If you are reading this, you probably do as well. I hope this post helps you to keep more money and pay less fees. It contains a list of banks that charge foreign visitors for using their machines and a list of the ones that do not.

Bankia (Avoid)

During my previous visits to Spain, Bankia was one of my go-to banks whenever I needed some cash. That’s no longer the case. Now, if you don’t want to pay ATM fees in Spain, you need to avoid Bankia like the plague. Every time you make a withdrawal from a Bankia ATM it charges a fee of €1.75.

And it gets worse.

When you originally enter your card into a Bankia ATM and key in the amount of money you want to withdraw, Bankia stakes claim to the money straight away. Then when you see there’s a fee and cancel the transaction the money is no longer available in your account.

When I was using a Bankia ATM in Madrid, the banking app on my phone beeped at me to let me know I’d made a withdrawal before I even got chance to cancel the transaction. Then I checked my account and it said the money would be returned within 7 days. Fortunately, it was available again within a couple of hours, but I needed cash sooner and had to transfer extra money to my account so I had cash available to withdraw from an alternative ATM. This is a situation that was new to me.

Unfortunately, I’ve discovered other Spanish banks do the same thing. So you need to be very careful when you select which bank to use.

BBVA (Avoid)

If you don’t want to pay any ATM fees during your time in Spain, BBVA is another bank you need to avoid. It’s been charging foreigners for making cash withdrawals for a very long time. Every time you make a cash withdrawal from a BBVA ATM, the bank hits you with a €1.87 fee and, like Bankia, it lays claim to the cash before you have made tje withdrawal.

IberCaja (Avoid)

IberCaja will also charge you every time you take cash out of one of its machines. At only €0.52 per withdrawal, the cost of using an IberCaja ATM is very low, but charges of any kind soon mount up. There are plenty of Spanish banks that don’t impose any fees at all so there is no need to deal with any of the banks that do. Like Bankia and BBVA, IberCaja claims the money before you even take it, placing it in limbo for a couple of hours or more (or possibly up to 7 days), so this is another Spanish bank I suggest you avoid.

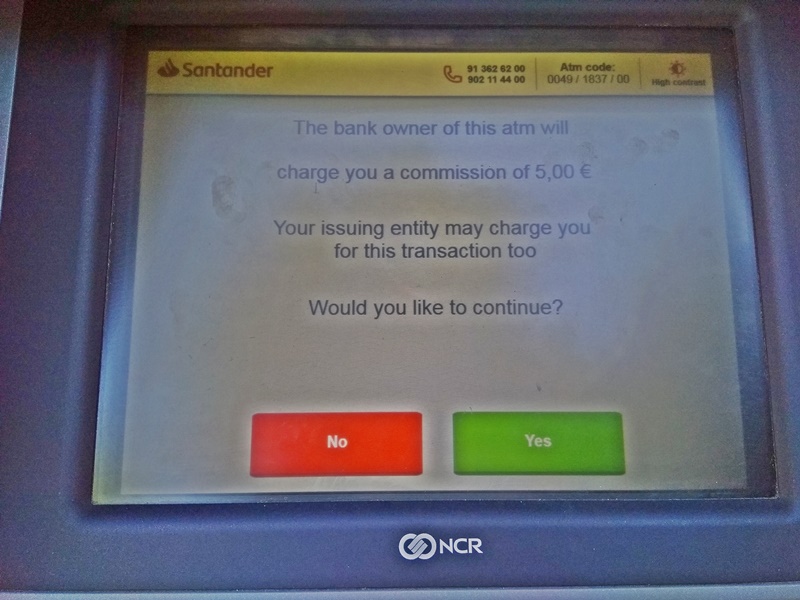

Santander (Avoid)

The good news is, Santander doesn’t claim your money and leave it in limbo. The bad news is Santander ATMs in will charge you €5 for every cash withdrawal you make.

As far as ATM fees go, Santander is the most greedy bank I found in Spain so it’s another one you may want to avoid.

UPDATE (October 2021): A site visitor has has just informed me Santander has increased its ATM withdrawal fee to €7. Now more than ever you definitely need to be waving two fingers at this bank. (Thanks for the Info Rob.)

Sabadell (Avoid)

Sabadell Bank will charge you for taking cash out of its ATMs too. At €1.80 per pop, it’s fees are very similar to those imposed by the majority of other Spanish banks that charge, but its still money down the drain. If you need to take money out of an ATM in Spain and don’t want to pay any withdrawal fees, Sabadell is another bank to avoid.

CaixaBank (Good Choice Avoid)

CaixaBank is one of my favourite Spanish Banks. It doesn’t charge any ATM fees at all. If you see one of its distinctive-looking yellow machines you can be sure you won’t have any extra charges when you make a withdrawal. Although, as with any other bank, avoid using dynamic currency conversion. This is an option many banks offer. It offers you the opportunity to let the machine to the currency conversion. It’s enticing because it lets you see how much money will be leaving your account back home. The problem is, the rate is always more expensive. The best thing to do is to select the option that shows you the cost in euros and let your own bank handle the conversion.

UPDATE: In September 2019, just a few days after I wrote this post, CaixaBank started to charge a €2 ATM withdrawal fee. This is now a bank to avoid.

Bankinter (Good Choice Avoid)

Bankinter is another one of the good banks. If you use one of its machines, the only money that will leave your account is the amount that you withdraw. Bankinter makes no additional charges at all.

UPDATE: As of June 2021, it appears Bankinter may has started charging ATM withdrawal fees and is no longer a tourist-friendly bank. If you check he comments section below, you will see a comment from Elizabeth who made a withdrawal from Bankinter and was hit with a charge of €4.

Eurocaja Rural (Good Choice)

Eurocaja Rural is a good choice as well. Its machines don’t hit you with any extra fees.

Unicaja (Good Choice)

Unicaja doesn’t charge fees either. So, if you want to avoid paying any of those nasty ATM fees in Spain, Unicaja is another good bank to use. Just remember not to accept the offer of dynamic conversion. It won’t work in your favour.

How to Avoid Fees from Your Own Bank When You Use an ATM in Spain

Avoiding Spanish ATM fees is only half the battle. Every time you use your card in Spain, there’s still a good chance you will be hit by foreign transaction fees made by your bank back home. Fortunately, there is a way to avoid it. I know. I’ve been doing so for over a year.

The trick is to open a Wise Multi-Currency Account. It’s easy to do and won’t cost you a thing. Formerly known as TransferWise, Wise was created especially to help people to avoid paying foreign transaction fees. It’s a reputable company and in June 2016, Richard Branson became one of the main investors. The fact that the company can win the backing of a business guru like that says a lot.

The Wise multi-currency account has a debit card</span you can use in machines anywhere in the world. All you do is transfer some money from your main bank account to your multi-currency account. You can do it online, but I prefer to use the app. Either way, the money hits your account very fast. Typically within just a few minutes.

Unlike normal banks, Wise uses the most up-to-date exchange rate. There is a small fee for the conversion, but it’s much less than the fees you get from normal banks.

When you are a regular traveller, like me, a Wise multi-currency account can save you a lot of money per year. If you want to get the most bang for your buck in Spain, the best thing to do is choose your ATM carefully to avoid paying fees and then use a Wise debit card to avoid paying fees to your own bank. To save more money, never use dynamic currency conversion.

You can get more information about the Wise multi-currency account HERE

Hi my understanding is that if you have a Santander account and use their debit card at a Santander bank in Spain you do not pay an ATM fee, is this still the case? Off to Spain shortly and want some euros from time to time during trip.

Hi Dawn,

Sorry. I have no idea. I only write about my personal experiences and I don’t bank with Santander.The best thing would probably be to inquire at your local branch or phone the Santander helpline. That way you can be confident you are getting accurate information. Good luck. Hope you enjoy your time in Spain.

I just tried caixabank, santander and bbva in Girona and they all tried to take 7€ in fees for the cash withdrawal.

That’s interesting. It’s four years since I wrote this post. Since then, the Santander ATM fee has stayed the same and the BBVA ATM fee, which was originally a lot less is now almost four times as much as it used to be. Back in September 2019, it was only €1.87 and I wasn’t even prepared to pay that. Charging people to access their own money is wrong. Especially when these fees appear to only apply to foreign visitors. Let’s not forget, when we visit foreign countries and withdraw money, the money we spend benefits the countries’ economies.

From the feedback I’m getting for this post, Unicaja ATMs appear to still offer free withdrawals. Maybe you should try one of their machines next time.

Nov 23, Unicaja charge €2.60 so it’s still the cheapest.

Thanks for the update Lindsey ;0

I got stung for €7 when I used Caixa in Alicante in June 2022. I couldn’t find another ATM in the vicinity and needed the cash, so I paid it. IberCaja ended up being the cheapest at something like 0.56 cents. Seems to vary across the regions. Will be trying in other places to see if the rates mentioned in the article are still ok. Thanks for doing this.

Hi Sonia,

Thanks for the info.

So, after three years, IbaCaja has only put up its charge by 4 cents, but Caixa has increased it’s ATM fee by €5 in the same space of time.

I’m against all ATM charges and always will be. However, your comment shows some Spanish banks are not as greedy as others. I dread to think what Santander may be charging these days.

I hate to be the voice of doom and gloom but I think that, within the next few years, ATM charges in all countries are going to get a lot worse.

There are many reasons why I say this. Too many to put in a comment. However, give it a few years and I don’t think anyboody will be telling me I was wrong.

Good luck with the search for a Spanish ATM that does not have fees. As far as I know, Eurocaja and Unicaja are still the best two options.

I am in Gran Canaria and couldn’t find an atm for either of the fee free banks you recommend but, with a bit of trial and error, I found a BancaMarch atm which did not charge a fee on my UK debit card. I used the one in Puerto Mogan near Hiperdino and I saw another today in Las Palmas. Hope this will help others avoid the exorbitant fees charged by the mainstream banks.

Hi Andy,

Thanks for the info. A lot of people may find it useful.

Which bank is your card with? It could be that your bank has some type of reciprocal agreement with BancaMarch. I’ve only every encountered this kind of arangement once. A few years ago, I spent a couple of months living in Odessa. At the time, one of the Ukrainian banks had a special agreement with Barclays that made it possible for me to avoid paying fees for withrdrawals I made with my Barclays debit card.

It will be interesting to see what kind of comments people leave about BancaMarch in the future.

Thank you so much for this. I’ve struggled to find fee free machines in Spain but Unicaja is as you advise fee free. Of course, the fx rate was a rip off – €1.04 v €1.18 (visa rate). Never take that offer!

Glad to help and it’s good to know the information I’m providing is still up to date.

In Barcelona a couple of weeks ago, Even with my Wise euro card, CaixaBank still charge €2 fee.

Sabadell only charged €1.80.

Santander’s ATM wanted a whopping €7!

Wise apply ATM fees also, even from Euro account.

– You can make 2 free withdrawals up to a total of £200 GBP each month.

– After 2 free withdrawals, you’ll pay £0.50 GBP per withdrawal.

– After £200 GBP, you’ll pay a 1.75% fee.

This is on top of any fee charged by the ATM in Spain.

Wise also say this: For ATMs, The most you can withdraw in one go is £1000, with a daily limit of £1500, and a monthly limit of £3000.

Hi Rob,

Thanks for the information.

I wrote this post based on my personal experiences using the machines. It lists the machines you need to avoid and points out the ones that are okay.

Since I wrote the post, things have changed a lot. Some of the banks that did not charge ATM fees have started to do so. Others have increased their ATM fees.

My blog visitors have been very helpful. The information, they have given me has allowed me to update the information where needed.

The information you have given me will help people too. In 2019, Santander tried to charge me €5 for making an ATM withdrawal in Spain. Thanks to you I now know Santandar has increased this by €2. That stinks. It was always the most expensive option and, at some point during the last two years its increased its ATM fees by 40%. It’s greed. Pure and simple.

Interestingly, the Sabadell ATM withdrawal fee is still the same.

As I mention in the blog post, you also need to avoid falling into the trap of dynamic currency conversion. If you don’t do the transaction in local currency, the ATM will rip you off even more. That’s all ATMs. Even the ones that do not charge withdrawal fees.

To be honest, I don’t see the need to make large ATM withdrawals. If you have a lot of cash in your pocket it gives you more to lose if you are targeted by a pickpocket or become a victim of street crime. I’ve had nothing but good experiences in Spain but a gang in Ukraine took everything I had on me including the keys to my Airbnb. These things can happen anywhere. The less you have on you, the less the Ba@*%?Ds can get.

I’m a big guy by the way. Over 6′ tall with extensive martial arts training. There’s strength in numbers though. Anyone can become a victim of street crime.

There’s another reason to avoid taking out too much money from ATMs. If you have a lot left when you leave the country, you will need to change it to your local currency or the currency of the next country you are visiting. That puts you at the mercy of the banks again or those terrible money exchange booths.

Hope this helped. Thanks again for the information about Santander. I will update the blog.

If you are still in Spain, I’m jealous. It’s much colder where I am now.

Just took 300 euros our of BBVA machine before I checked your website. They charged 2% ie 6 euros. Definitely one to avoid

Hi Geoff,

Next time try Unicaja or Eurocaja Rural. As far as I know, both are still offering fee-free withdrawals. Be sure to withdraw in local currency though. If you allow the machine to do the conversion and take the money from your account in your home currency, it will rip you off. It’s the same with all ATMs. Doing the transaction in local currency (euros in this case) will always get you the best deal.

Steve, I’ve just withdrawn €50 from a Unicaja cash machine with my Revolut card in La Cala de Mijas Spain. I had only euro on the card and thought I had outwitted it when it stated I was going to be charged £48.82 in sterling. However the bugger was smarter than I was as it managed to deduct €57.41 from the Euro wallet on the card without me copping on. An expensive lesson!!

Hi Declan,

That sounds like you may have allowed the machine to work out the conversion rate instead of your card issuer. It’s called dynamic currency conversion and it always costs you more. The best thing to do is take the option that allows you to do the transaction in local currency and let your bank/card issuer do the conversion.

ATMs don’t know what currency is on your card. They can’t access that kind of information but they appear to be able to tell the country of issue. Revolut is based in the UK, so the machine will have offerd to convert to GBP.

I’ve just moved to Spain and prior to coming over I changed my bank to Virgin as they are one of only three banks I could find (the other two I’d never heard of) who do not charge for using your card abroad. So when I went to get some money out of a Spanish ATM the other day I thought I’d taken all the necessary steps to avoid having the banks thieving my pennies. I was therefore more than a little bit annoyed to find that the Spanish bank was going to charge me a fee for accessing my money. In total I tried three different ATMs; ING, La Caixa and Santander with the charges ranging from 2 to 5 Euros if my memory serves me. In the end I didn’t take any money out as I was so disgusted with the charges. It’s something the British banks tried a number of years ago but ended up having to go back to free cash withdrawals after huge public outcry. I’ll definitely give Eurocaja and Unicaja a try now that I’ve read your article, thank you very much!

Hi Chris,

Several fees can occur during ATM transactions. Even if your card provider (in your case Virgin) does not charge fees when you use your card abroad, the bank that owns the ATM may do so. In a worst-case scenario, you could pay fees to both.

These are not the same as the fees some British banks used to try to charge customers for using cash machines in the UK. That was a totally different game of greed.

At the moment, Santander is one of the worst Spanish banks for charging ATM fees. If I used a card from a British bank and took out €200, Santander would take €205 out of my account (€200 cash for me + €5 for Santander). If I was using a NatWest card, for example, Natwest would charge me additional fees for using my card abroad. Natwest would also add fees if I made purchases using my card.

If I opened up a bank account in Spain, even with Santander, I would be able to make free cash withdrawals in Spain but the bank would charge me fees if I used ATMs in the UK.

If I took money out of an ATM in Spain and let it handle the exchange rate the machine would rip me off on the exchange rate. It would tell me how many GBP would leave my account but give me less euros for my money than I would get if I took out the money in local currency and let my British bank work out the exchange rate.

TIP: Always make withdrawals in local currency.

It will save you a lot of money. Letting the ATM work out the details can involve a mark-up of up to 18%.

I don’t use Virgin Bank, so I cannot comment on their fees.

Hope this helps.

Hi Steve,

Sorry for the late response, that’s really helpful thanks!

I’m currently in the process of opening a Spanish account which I will be using solely in Spain. Once opened I have a few thousand I want to transfer from my Virgin account but before I do so, I will compare the costs with Wise. Virgin don’t charge for overseas transactions and apparently offer favourable exchange rates compared to the majority of other banks but, having said this, Wise may still work out cheaper.

Hi Steve,

The information in my previous message was completely wrong. It turns out there is a £25 fee with Virgin plus it cannot be done digitally; I have to visit a branch and fill out a form to complete the transaction. I will definitely be taking a look at Wise now!

Many thanks for all your help

Chris

Hi Chris,

Happy to help. Hope everything goes okay. I thought the idea of a high street bank not hammering its customers sounded too good to be true but, as I said, I’m not familiar with Virgin Bank.

Steve

I have accounts with Barclays in UK and Sabadell in Spain (ES). I have my state pension paid direct from Government in euros but my private pension is paid in UK bank. I do this to try to save. I don’t have a large income. When I need to transfer money from UK to ES I pay no charges in UK but get hit with 18 euros by ES. So when I need to transfer £900 + I use that method but for smaller amounts I use local Caixa ATM.eg. 16/6/21- €300 withdrawal; €2 charge; Barclays shows €302 withdrawal; Debit £267.66 conversion 1.162021 final amount incl. transfer fee £7.77.

Hi Debbie,

You can avoid that €2 ATM fee by using a Unicaja machine. Unicaja still isn’t charging any fees for withdrawals.

Hope this helps.

Thank you

BoA issued a $25 charge after my 600 EUR withdrawal from a Unicaja ATM in Barcelona

Hi Austin,

That’s shocking. It’s money for nothing for BoA.

At least by choosing Unicaja, you avoided the ATM fees most other Spanish banks would have charged you on top.

If you’d have chosen Bankinter, for example, you’d have taken €600 out but the dollar equivalent of €604 would have been taken out of your BoA account (€600 + €4 ATM fee).

Banks have a lot of ways of making money, yet they are very stingy when it comes to paying people interest on their savings.

Always used Bankiter but yesterday I was charged €4 to withdraw €300 They said they now charge to withdraw at ATM Thought that was a bit steep.

Hi Elizabeth.

Thanks for the information. More and more banks seem to be starting to charge for withdrawals now. For them, it’s money for nothing. It puts a new spin on the term “bank robbery.” Fortunately, Spain still has some banks that don’t charge ATM fees. Some countries do not.

Makes a mockery of the fact the ATM’s were first introduced to save on labour as they could reduce their bank staff. Now they want to charge you to access your own money they give you zero percent interest for. Shocking.

Never thought about it like that before but you are absolutely right.

As for the interest (or lack of it), I don’t know how they justify it. Back in the 80s I could get 11% interest on a post office investment account. I can’t remember what my main bank was paying. It wasn’t as much as that but it was reasonable amount. They just kept reducing it bit by bit, got away with it, and then did it some more. Now bank interest on savings is a joke. Bearing in mind how much interest they charge borrowers, it’s nothing short of exploitation.

Hey Elizabeth! The same thing happened to me 🙁 did you find an alternative that doesn’t charge a fee yet?

Same here, hope the rest don’t

Avoid Caixa by all means, on the top of the €2 fee I was charges 8. 5% on the machine conversion.

I also had success making a no-fee withdrawal from Unicaja. As noted in the post, you have to be absolutely sure to select “Continue WITHOUT conversion” when presented with the option to withdraw using the bank’s offered exchange rate. The total charge would have been about *10 PERCENT* higher had I gone with that option. Outrageous.

Hi,

I’ve just relocated to Camposol in Mazarrón, only been here 2 weeks.

I’m having these charges when I use my card which is from my bank in France.

My question is, will I benefit from free ATM withdrawals when I have a Spanish bank account.

Really would appreciate your expertise please.

Hi Harry,

I’m not sure what you mean by “these charges”. Is it the ATM charging you or your bank?

If the ATM is giving you fees it will warn you on the screen before it gives you any money.

You can avoid those fees by using a machine belonging to one of the “good choice” banks I mention in the blog post. Unicaja, for example.

If things have changed since I wrote the post, and one of the “good choice” banks has started charging, just try an ATM provided by one of the other “good choice” banks instead. That will allow you to withdraw cash without paying any fees (to the bank providing the ATM).

I’d be surprised if your French Bank charges you for withdrawing euros in Spain because France uses the same currency.

However, if your French bank is charging you, those fees will add up and cost you a lot of money. Obviously, you don’t want that. Who would?

In a case like that, it would make sense to open an account with a Spanish bank. Ideally, one that has ATMs that are handy for you to access. It does depend on your personal circumstances, though.

Harry Wragg does not sound like a French name. If you are originally come from the UK or from a European country that does not use the euro, opening a Spanish bank account may not be the right answer for you unless you are working in Spain and living on money your employer is paying into your bank account. Or using money held in euros elsewhere in Europe.

If you are from a non-euro-using country and are presently regularly transferring savings to your French bank account you will be paying over the odds on the exchange rate and getting charged a fee for every transaction. The same would happen if you receiving a salary (paid GBP, USD, etc.) into a bank account in France or Spain. That’s a waste of money.

As I said, I’m not sure which fees you are presently getting and trying to avoid but I hope I have been able to help.

Steve

Normally use CaixaBank in Benidorm, mind you there machines are not atms but more like supercomputers to me. Didnt know about the €2 charge until it showed but though nothing of it. Will ise Bankinter which there is only 1 small on in the Old town. Never used Santander bit have a UK account with them and there awful. Thanks for the article cheaper than the exchange shops with my bank card.

Hi Jack,

I know what you mean about the CaixaBank machines. It’s the only bank I know of that has that type of ATM. I think the bank may be phasing them out though. The last time I was in Spain I noticed some branches had machines that looked pretty much like the ones other banks use.

I agree, Santander is awful—in every way. The Santander banks in the UK have new machines now. There are no buttons. You have to do everything on the screen. Sometimes the sensors don’t register the finger action. Other times they do but take a long time to respond.

I have a family member who banks with Santander. She’s still self-isolating so she sends me to get mini-statements. It’s very frustrating. I’ve used ATMS all over Europe, those new Santander machines are the worst I’ve ever encountered.

I’ve just been hit with a charge of £8.21 TWICE by Lloyds for using a Spanish atm. First time ever

Hi Arlene,

I used to have the problem when I was using a Nat West debit card. All those charges add up fast. It’s just easy money for the banks.

in August no charge at la caixa for atm use with uk debit card, today same debit card 2 euro charge (24/09/19)

Hi Colin,

Yes. A Caixa ATM wanted to hit me with a €2 charge a couple of days ago as well. I was going to try again before updating the post. Now I won’t need to. Thanks for sharing the information.